If you purchase a vehicle to use in your business, you can potentially use Section 179 to deduct the full cost of that vehicle in the first year. 100% bonus depreciation is only available through 2022 in 2023 it begins to phase out and will be gone completely by 2027. Section 179 will always be an option to you.

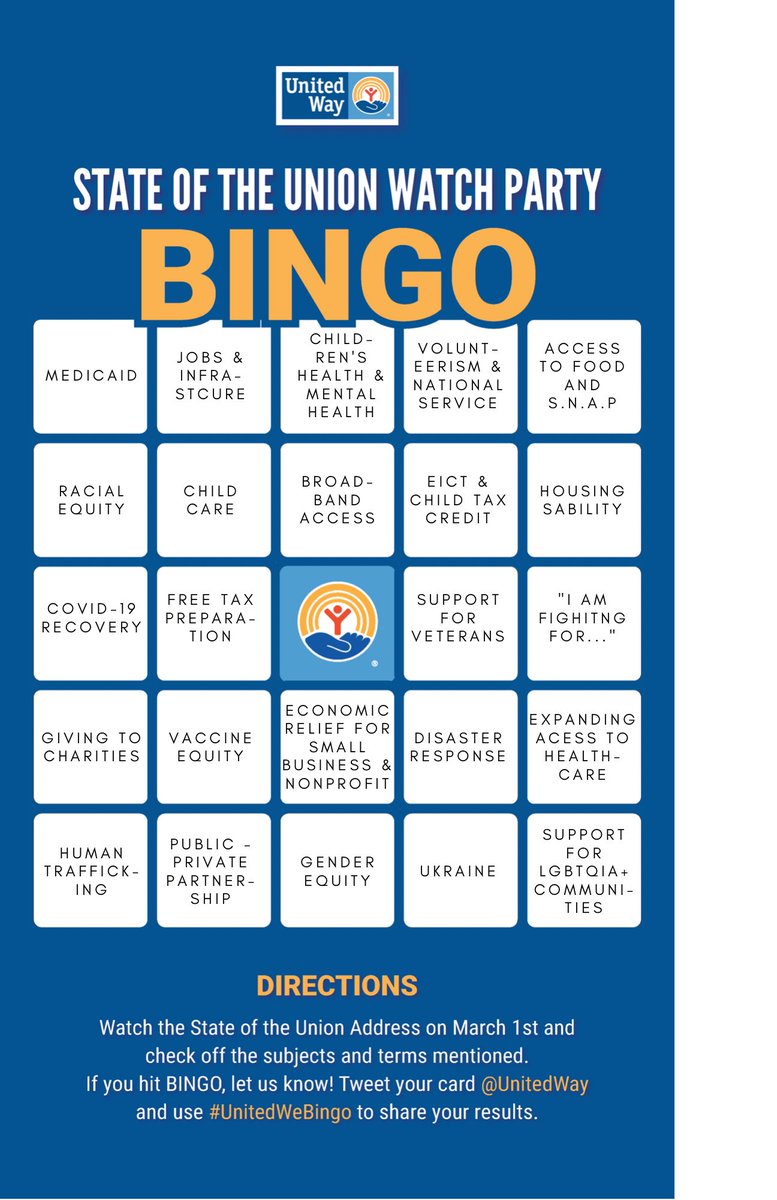

Over the past two decades, bonus depreciation has expired and has been brought back many times, making it a difficult tool to use for long-term tax planning. Section 179 is a permanent addition to the tax code For example, if you want to apply bonus depreciation to your vehicles, you must also apply bonus depreciation to all other assets with 5-year MACRS tax lives. In contrast, you must take bonus depreciation uniformly across asset classes. You can apply Section 179 depreciation to individual assets. You can choose individual assets to expense using Section 179 Bonus depreciation can exceed your taxable income the excess will generate a net operating loss (NOL) that you can use to reduce taxable income in future years. Section 179 can only reduce your taxable income down to zero. In contrast, there is no deduction limitation or spending cap for bonus depreciation.

In 2022, the maximum Section 179 expense deduction is $1.08M, and if you purchase $2.7M of assets in a year, this max deduction will start to phase out. But there are a few important differences. Section 179 and 100% bonus depreciation are similar: they both help businesses fully deduct asset costs in the year of purchase.

How Is Section 179 Different Than Bonus Depreciation? Become our partner and offer wealth management, investments, insurance and advanced planning to your existing clients.

0 kommentar(er)

0 kommentar(er)